Specific Examples

Below are some items that are ambiguous in their customs classification.

This ambiguity can lead to significant penalties, including the seizure of goods (the means of transport in which the goods are loaded may also be involved in the event of in-line customs clearance) and the possible initiation of criminal proceedings for smuggling if the difference between the duties paid and those actually due exceeds €10,000, as provided for by Legislative Decree 141/2024.

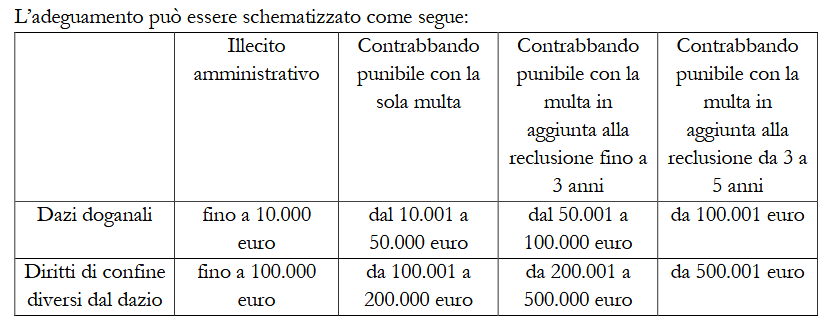

With Legislative Decree No. 81 of 12/06/2025, the thresholds have been amended as follows:

If the aggravating circumstances referred to in Article 88 do not apply, the violations referred to in Articles 78 to 83 are committed unless, alternatively:

a) the amount of border duties payable as customs duty, owed or unduly received, or unduly requested for reimbursement, exceeds €10,000;

b) the total amount of border duties other than customs duties, owed or unduly received, or unduly requested for reimbursement, exceeds €100,000.